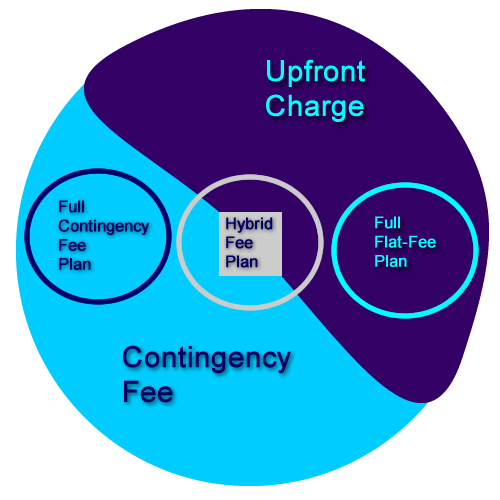

Property Tax Appeal Service Plan Diagram:

Property Tax Appeal Service Plan Summary:

Full Contingency Fee Plan: This is where the client pays a fee for our services based upon the amount of property tax savings achieved.

Hybrid Fee Plan: This is a cross of the Full Contingency Fee Plan and the Full Flat-Fee Plan, where the client pays an upfront fee and also a contingency fee based upon the amount of property tax savings achieved.

Full Flat-Fee Plan: This is where the client pays an upfront fee without a contingency fee.

Property Tax Appeal Service Plan Detail:

Full Contingency Fee Plan Detail:

Property Tax Analysis, Evidence Composition, & Filing:

No Upfront Charge: Attorneys are involved and assigned per Board of Review/Property Tax Appeal Board hearing schedule, where applicable. There is absolutely no upfront charge for the analysis of your property taxes or the filing of your tax assessment appeal(s).

Property Tax Savings:

50% Contingency Fee: It is agreed that the Tax Appeal Tech fee will be contingent upon appeal outcome, there will be No Charge to you if no assessment reduction is obtained. It is agreed that you will pay Tax Appeal Tech one half (50%) of the first year’s “Estimated Tax Savings” as Tax Appeal Tech’s fee resulting from any reduction in your property’s assessed value obtained for you at the respective County Assessor, Board of Review, Property Tax Appeal Board.

Estimated Tax Savings Calculation Formula:

Pre Appeal Assessed Value *

Latest Property Tax Rate *

Latest County Multiplier =

Pre Appeal Tax Amount

Post Appeal Assessed Value *

Latest Property Tax Rate *

Latest County Multiplier =

Post Appeal Tax Amount

Pre Appeal Tax Amount (-)

Post Appeal Tax Amount =

Estimated Tax Savings

Invoice Formula for Full Contingency Fee Plan:

Estimated Tax Savings *

50% Contingency Fee =

Invoice Amount

Hybrid Fee Plan Detail:

Property Tax Analysis, Evidence Composition, & Filing:

Upfront $95 Charge: Attorneys are involved and assigned per Board of Review hearing schedule, where applicable. There is a one-time $95 upfront fee for the analysis of your property taxes and the filing of your tax assessment appeal(s).

Property Tax Savings:

35% Contingency Fee: It is agreed that the Tax Appeal Tech fee will be contingent upon appeal outcome, there will be No Charge to you if no assessment reduction is obtained, outside of the non-refundable $95 Upfront Fee. It is agreed that you will pay Tax Appeal Tech thirty-five percent (35%) of the first year’s “Estimated Tax Savings” as Tax Appeal Tech’s fee resulting from any reduction in your property’s assessed value obtained for you at the respective County Assessor, Board of Review, Property Tax Appeal Board.

Estimated Tax Savings Calculation Formula:

Pre Appeal Assessed Value *

Latest Property Tax Rate *

Latest County Multiplier =

Pre Appeal Tax Amount

Post Appeal Assessed Value *

Latest Property Tax Rate *

Latest County Multiplier =

Post Appeal Tax Amount

Pre Appeal Tax Amount (-)

Post Appeal Tax Amount =

Estimated Tax Savings

Invoice Formula for Hybrid Fee Plan:

$95.00 Upfront Fee +

(Estimated Tax Savings *

35% Contingency Fee) =

Invoice Amount

Full Flat-Fee Plan Detail:

Property Tax Analysis & Evidence Composition:

$195 Flat-Fee: With our flat-fee package you will receive logically presented information pertaining to your home and neighborhood that’s necessary to make a strong argument for the reduced assessment level determined to most appropriate by county officials. Pro se reports are intended for clients that have the time and desire to appeal their property taxes, but would like assistance constructing their argument in a persuasive manner, and would rather not pay a portion of their savings upon success. No attorneys are involved.

Property Tax Savings:

0% Contingency Fee: With the flat-fee reports, you do the filing yourself, and you get to keep all of your savings and refunds. And you involve no attorneys because you’re appealing Pro Se (meaning “for oneself” or “on one’s own behalf”).

Invoice Formula for Full Flat-Fee Plan:

$195.00 Upfront Fee +

$0 Contingency Fee =

Invoice Amount